30s Summary

Bitcoin’s volatile market performance is leading traders to amplify gains using options coupled with the leveraged 2x long ETF linked to MicroStrategy’s share price. Trading volumes in these options have surged, particularly for deep out-of-the-money higher strike calls. This bullish sentiment is also observed in options tied to BlackRock’s bitcoin ETF. Despite potential risks, optimism prevails due to expected regulatory ease under President-elect Trump and anticipated Fed rate cuts. Bitcoin recently set new lifetime highs, fueling this trend.

Full Article

The crypto market is currently flourishing with increases and decreases in bitcoin prices giving it the thrill of a roller coaster ride. As bitcoin races towards the $100,000 mark, traders are amplifying gains using options associated with the already leveraged 2x long exchange-traded fund (ETF) linked to bitcoin holder MicroStrategy’s share price.

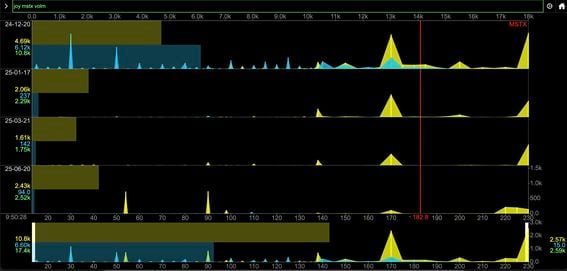

The Defiance Daily Target 2X Long MSTR ETF, which trades under the ticker MSTX on Nasdaq, tries to deliver 200% of the daily performance of MSTR’s share price. As MSTR increased by 10% to reach $473, this ETF also increased, rising by 20% to briefly top $180.

What really caught everyone’s attention was the rise in trading volumes in options linked to the ETF as market participants began to show interest in the deep out-of-the-money (OTM) higher strike call option at $230. Deep OTM calls are usually cheaper than those near the market rate of the underlying asset but offer potentially larger payouts.

The high demand for the $230 strike call was spread across multiple expirities, including contracts set to settle on June 20, 2025. A call option gives the buyer the right (but not the obligation) to buy the underlying asset at a predetermined price on/before a specific date, enabling the buyer to control a large position in the underlying asset while paying a minimal upfront premium.

This extreme bullish sentiment isn’t confined to the MSTR options market. Flows on the CME, Deribit, and nascent options tied to BlackRock’s spot bitcoin ETF reflect a similar attitude, highlighting a buildup of speculative excesses typically leading to market corrections. Such optimistic views cannot, however, ignore the risks. The market anticipates a friendly regulatory approach under President-elect Donald Trump and Fed rate cuts. The leading cryptocurrency, bitcoin, set new lifetime highs above $97,000 early Thursday, making a month-to-date gain of 38%.