30s Summary

Bitcoin is nearing a $2 trillion market cap after adding $30,000 in value since the US presidential election, and only needs to reach a price of about $101,000 per unit to hit this landmark. The cryptocurrency’s future open interest on the Chicago Mercantile Exchange has hit a record 218,000 BTC, indicating bullish market sentiment. Research suggests much growth comes from active futures market participants and options tied to US spot ETFs should aid this. Futures contracts margined in crypto being at a record low of 16% implies future Bitcoin price volatility should decrease.

Full Article

Bitcoin is inching closer to a $2 trillion market cap after its value increased by $30,000 since the U.S. presidential election. At present, it stands at $1.93 trillion and needs a price of around $101,000 per Bitcoin to reach the $2 trillion mark. This would be a historical milestone for Bitcoin, showing its viability and popularity as a digital currency.

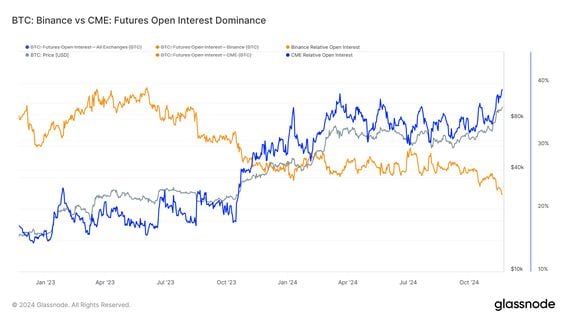

Bitcoin’s future open interest on the Chicago Mercantile Exchange (CME) has also reached a record high of 218,000 BTC, which is equivalent to $21.3 billion. So, what’s future open interest? In simple terms, it’s the total amount of outstanding future contracts. A future contract is an agreement between two parties to buy or sell an asset at a predetermined price at a specified time in the future. The high future open interest suggests a bullish market sentiment.

Research from K33 notes that a lot of this growth comes from active and direct participants who are directly involved in the futures market. The introduction of options tied to U.S. spot ETFs should further help CME futures to grow.

The other noteworthy fact is that the percentage of futures contracts that are margined in crypto and not in cash is at an all-time low of just 16%. This lower number suggests that we should see less volatility in the Bitcoin price in the future.